Upgrading your home with energy-efficient windows, doors, or skylights is a smart investment that improves comfort, efficiency, and long-term property value. According to Natural Resources Canada, windows, doors, and skylights can account for up to 25 percent of total home energy loss if not properly insulated or upgraded.

Many Canadian homeowners take advantage of rebate and tax credit programs to reduce the upfront cost of these upgrades. To receive those benefits, however, every detail of your energy tax credit paperwork must be correct and complete.

This article explains what documents to keep, how to organize them, and why small items like NFRC stickers and invoices play a critical role in getting your rebate approved.

Understanding Energy Tax Credit Documentation

Energy tax credit paperwork is the collection of records used to verify that your project meets government requirements for energy efficiency incentives. Rather than a single form, it’s a bundle of materials that together confirm what you purchased, when it was installed, and how it performs.

Each document works as proof for a specific part of your claim:

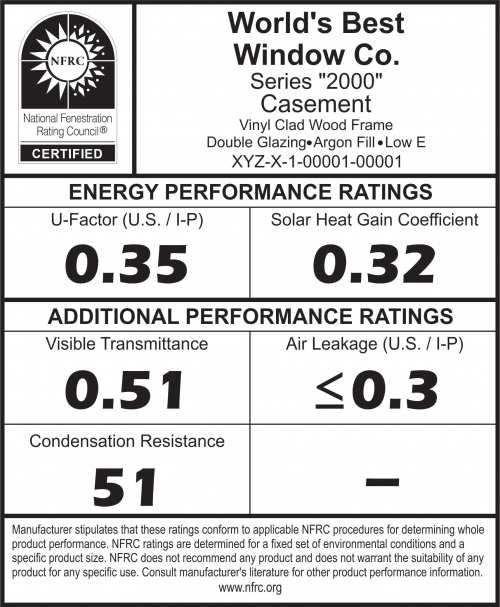

- Product performance: NFRC ratings or manufacturer certifications showing the product meets recognized energy standards.

- Purchase verification: Paid invoices confirming the model, quantity, and cost.

- Installation confirmation: Contracts and payment records verifying where and when the products were installed.

Without these documents, your rebate or tax credit application could be delayed or denied.

Why Proper Documentation Matters

Keeping this paperwork in order protects both your finances and your eligibility. As Statistics Canada notes, energy upgrades such as new windows and doors significantly improve household efficiency and directly impact national energy consumption trends.

Rebate programs like the Canada Greener Homes Grant require complete evidence of every qualified purchase. The government does not accept verbal statements or partial records.

Your documentation serves several purposes:

- Confirms that your windows, doors, or skylights meet energy performance standards.

- Verifies purchase and installation dates fall within program timelines.

- Establishes that the installation was performed in your primary residence.

- Provides protection if your claim is ever reviewed or audited.

Having everything in one place ensures a smooth claim and avoids unnecessary back-and-forth with program administrators.

The Homeowner’s Paperwork Checklist

Each incentive program may differ slightly, but the following documents are generally required. Missing even one item can put your claim at risk.

| Document Type | What It Is | Why You Need It |

| Itemized Sales Invoice | The final detailed bill from your contractor or retailer. | It must include the purchase date, full payment, and clear product identification (make, model, manufacturer). |

| NFRC Stickers | Labels attached to the glass of your new windows or doors. | The most important proof. NFRC (National Fenestration Rating Council) stickers display U-factor and SHGC values, confirming product performance. |

| Manufacturer’s Certification | A signed statement from the manufacturer. | Verifies that the specific product model qualifies for a tax credit. Usually available for download from the manufacturer’s site. |

| Installation Contract | The signed agreement with your installer. | Confirms the service address and completion date. Essential when using a certified window specialist. |

| Proof of Payment | Bank statements, cancelled cheques, or financing documents. | Demonstrates that you paid for the project in full, matching the invoice total. |

How to Choose Eligible Products

The simplest way to avoid future paperwork issues is to start with the right products.

- Check program criteria: Each credit or rebate lists the required energy ratings. Ensure the products are ENERGY STAR Canada certified. The ENERGY STAR Program reports that replacing old windows with certified models can reduce household energy bills by up to 13 percent on average.

- Read the NFRC label: Before purchasing, look for U-factor and SHGC values that meet the performance range for your climate zone.

- Confirm with your installer: Let your contractor know you are applying for a credit so they can prepare a properly itemized invoice listing full model details.

- Keep packaging and labels: Do not discard anything until your rebate is finalized.

By checking eligibility early, you save time and ensure your investment qualifies from the start.

Frequent Homeowner Mistakes

Many homeowners lose rebates because of small, preventable errors during or after installation. Common mistakes include:

- Throwing away NFRC stickers: Always remove them carefully before or during installation and store them. A simple solution is to attach them to your invoice or a sheet labeled “Energy Credit Proof.”

- Accepting generic invoices: A vague line such as “Window replacement – $10,000” is not valid. Every product must be listed with its model name and manufacturer.

- Misplacing documents: Create a dedicated folder, both physical and digital. Scan every invoice and contract and back them up in cloud storage.

- Missing deadlines: Each program has fixed eligibility dates for purchase and installation. Ensure your project fits within that timeframe before applying.

Balancing Requirements and Reality

Although the paperwork process can seem tedious, it protects both homeowners and the integrity of public programs. These measures ensure that funds are used only for certified, high-performance products that truly reduce energy consumption.

Contractors sometimes view sticker collection or detailed invoicing as unnecessary. However, without verifiable proof, the homeowner bears the full risk of losing rebate eligibility. Understanding this responsibility helps both sides maintain proper documentation from day one.

Frequently Asked Questions (FAQ)

1. What should I consider when gathering energy tax credit paperwork?

You must be meticulous. The key aspects are proving the product qualifies (NFRC sticker, manufacturer’s certification) and proving you paid for it at the correct time and location (itemized invoice, installation contract).

2. How do I choose the best windows for a tax credit?

Look for the ENERGY STAR® Canada logo. Before buying, compare the U-factor and SHGC ratings on the NFRC label to the requirements for your specific climate zone as listed on the official government program website. Our article on windows and doors replacement in Canada can provide more context.

3. What are the advantages and disadvantages of these paperwork requirements?

The main advantage is that the system ensures only legitimate, high-efficiency products are subsidized, upholding the program’s integrity. The primary disadvantage is that the process is unforgiving. A simple mistake, like throwing away a sticker, can cost a homeowner thousands of dollars in rebates.

Conclusion

Claiming government tax credits for your energy-efficient upgrades is simple if your documentation is organized from the start. Save every invoice, certification, and contract, and keep the NFRC stickers from each product.By maintaining a clear record, you not only protect your rebate but also ensure your project complies with Canadian energy standards. The Canada Greener Homes Initiative outlines the required documentation and steps to verify eligibility for energy-efficiency incentives.